An entrepreneurial journey is full of key decisions—don’t make them alone.

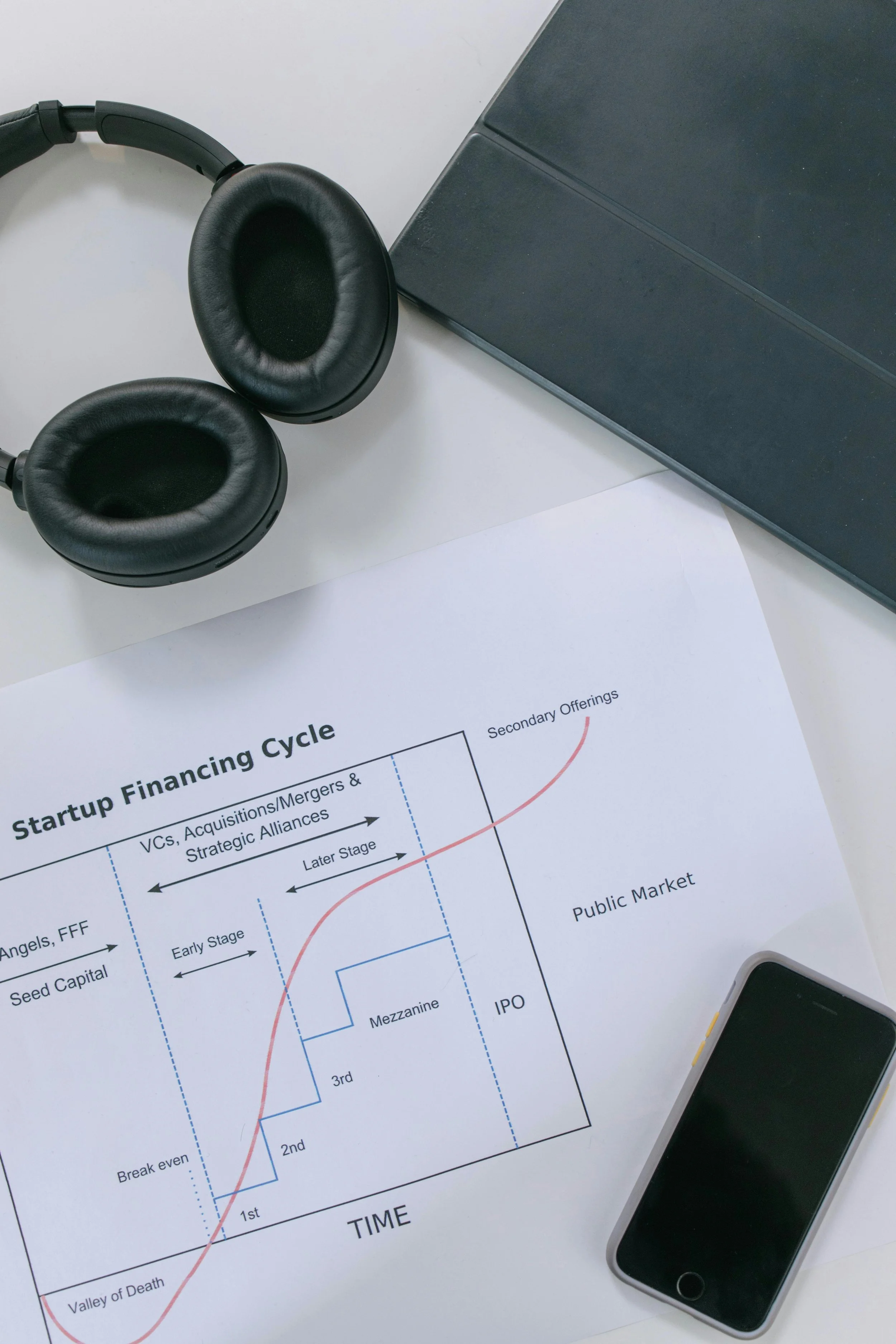

Fundraising Program

Join our proven fundraising program with three key phases:

Preparation

We guide you in your business plan, pitch deck, data room construction & give you the best practices to meet investors.

Go to investors & banks

Get introduced to our extensive network of private investors, venture capitalists, and banks.

We support you in the due diligence process.

Negotiation

We support you in negotiating with investors & banks to secure financing and ensure favorable terms and conditions.

Exit - M&A

At Fractional, we specialize in guiding entrepreneurs, investors, and shareholders through every stage of their M&A journey, whether on the sell-side or buy-side.

Our approach is built on key elements essential for success:

Market Screening: Identifying potential opportunities in the marketplace.

Enterprise Valuation: Assessing the true worth of your business.

Dataroom Construction: Creating a secure space for due diligence documentation.

Target Identification: Pinpointing the right acquisition or investment targets.

Negotiation: Securing favorable terms and conditions for your deal.

Deal Closing: Ensuring a smooth and efficient transaction process.

With our expertise, you can confidently navigate the complexities of mergers and acquisitions.

We can also help you with:

Business plan

Debt structuration

Governance set-up (shareholder agreement, board of directors organization, …)

Enterprise Valuation

Exit management

…